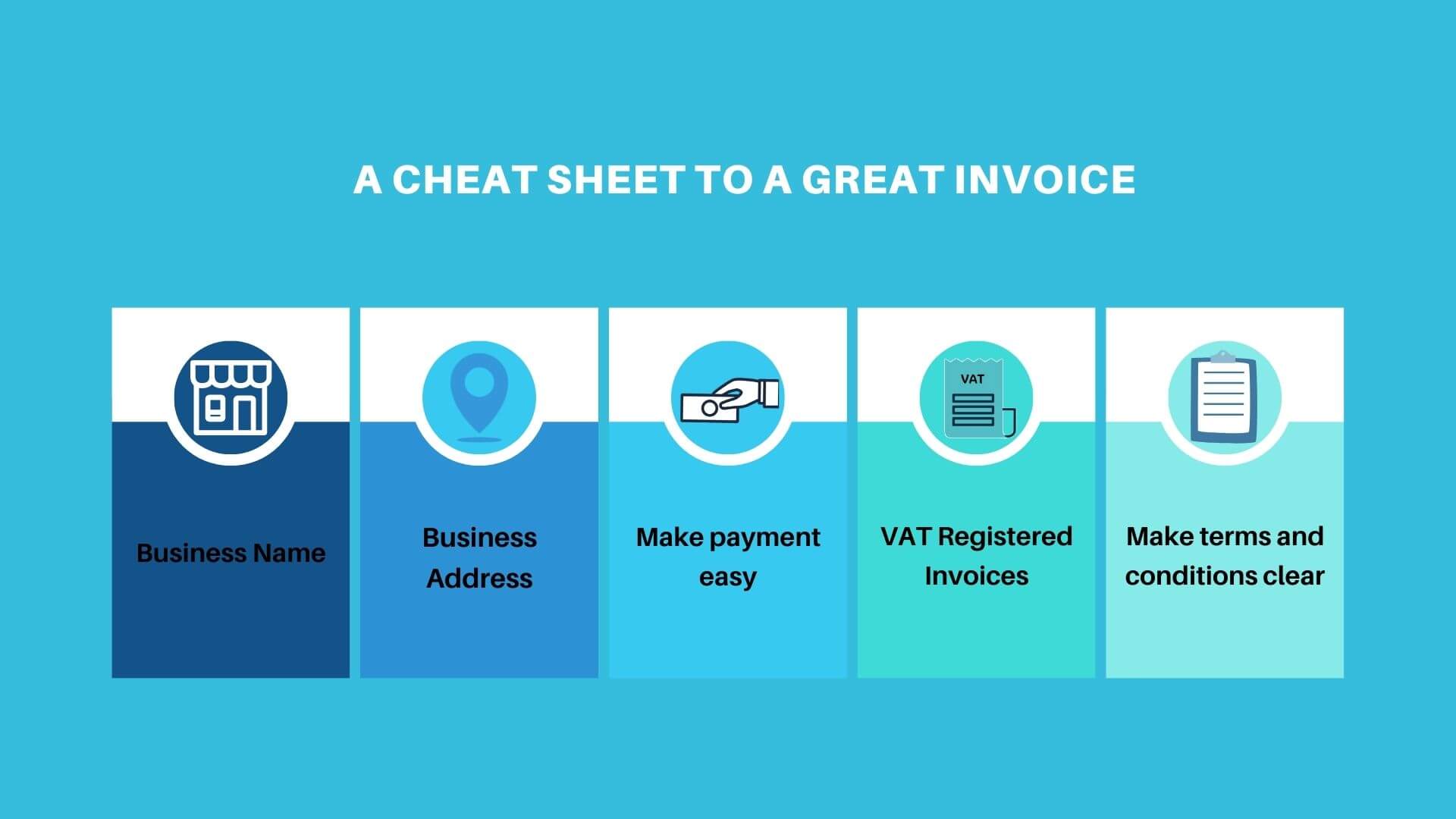

A Cheat Sheet to A Great Invoice

Overview

The importance of cashflow in your business cannot be emphasised enough and creating the right invoices go a long way in securing timely payments. How embarrassing and crushing it could be when your payments are denied because you did not use the right format in creating your invoices? Given that there are different business types such as sole trader, company, partnership, pharmacy or an educational institution and VAT added to the equation, you must create custom invoices for each business type. That could indeed be the difference between an invoice that secures timely payments and the one that fails to. Many businesses fail to follow this rule and cash crunch cripples them. This post gives you a cheat sheet of creating the right invoice type for businesses. On this note, it is relevant to state that creating multiple invoice types manually or with a software that does not support creating custom invoice types can increase effort overhead. Invest in a smart software solution and get this done quickly, every time.

If you are a sole trader

Then the invoice must include the following information.

Your name, the business trading name that is used and the business premises address if you are using the business trading name.

If your business is a limited company

Then the invoice must include the following information.

If you must issue VAT-registered invoices

You need to provide a VAT invoice that provides the VAT charged on the supply of goods or services. You need to retain a copy of the invoice including those that are issued by mistake or those that are cancelled. You can issue three types of VAT invoices – Full version, Simplified version and Modified version. While the full version can be used for all types of supplies of goods and services, the simplified version and modified version can be used for amounts for over €250 and under €250. respectively.

Other Tips

While the above takes care of the legalities of creating the right invoice type, it is important to keep in mind other things that will ensure that invoices are paid on time. Consider this a cheat sheet that will provide you an advantage over others.

Make payment easy

Make paying easy for your customers. Ideally, you should provide multiple payment options and allow the customer to choose the most appropriate payment option for them.

Make terms and conditions clear

Cut the clutter and state the payment terms and conditions clearly and categorically. For example, you can write “Payment must be made within 30 days” or a little politely. “Please make all arrangements for paying the invoice within 30 days from the date of issuing the invoice.”

Good software solutions take a lot of pain away from creating and crafting the custom invoices and the appropriate terms and conditions.